Split currency risk model business unit setup

If you do not need to conform to GAAP or euro regulations, then the base currency can be defined as the pivot currency. In this case, the third currency value can be either second base or reporting currency. In practice, if the base currency is the pivot then Value 3 is usually used as a reporting currency.

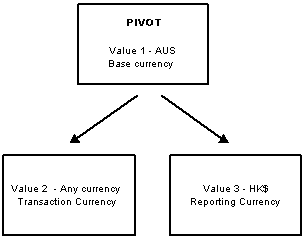

Take an example of an Australian subsidiary of a Hong Kong company. The base currency is Australian dollars and the reporting currency is Hong Kong dollars. The base currency also acts as the pivot currency.

In this scenario the subsidiary is taking the exchange risk against the local currency and the parent company is taking the risk between the local base currency and the reporting currency.

This is illustrated below: