Business Example 1 - Weekly Overtime Plus Rule

This example covers these business needs:

- Employees are paid at time and half their normal rate for every hour they work beyond 40 hours a week. Beyond 50 hours a week, employees are paid double-time. The overtime rate is paid on the time which earned employees the overtime.

- Employees can earn overtime for unpaid time spent in training.

- Employees should not be paid at a lower rate than they have already earned, when overtime rates are assigned.

Configuration

Condition: Always True

Rule parameters:

| Parameter | Value |

|---|---|

| Hour Set Description | REG=2400, OT1=600, OT2=9999 |

| Work Detail Time Codes | WRK, TRN |

| Work Detail Hour Types | REG, UNPAID, OT1, OT2 |

| Eligible Overtime Period | Week |

| Assign equal or better hour type to overtime work details | Selected |

The Auto Recalc parameter in the Quick Rule Editor is set to ENTIRE WEEK.

Results

1a - Employee earns overtime

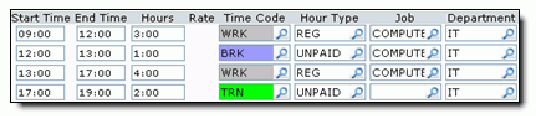

In this example result, the employee works from 9:00 to 17:00 and then attends training from 17:00 to 19:00 on Monday through Friday, taking an hour break each day at 12:00.

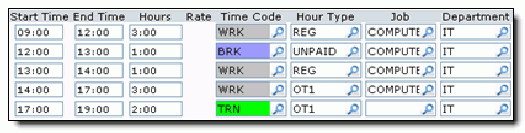

Since the unpaid training time is considered eligible work, the employee worked 45 hours (2700 minutes) of eligible time, 5 hours of which is beyond the regular rate threshold, earning the employee overtime. The last 5 hours the employee worked in the week earned overtime, so the rule assigns the overtime rate to this time.

These tables summarize the employee's pay for the week before and after the overtime is paid.

Before overtime:

| Hours | Time Code | Hour Type | Rate | Paid |

|---|---|---|---|---|

| 35 | WRK | REG | Regular rate at $10 an hour | $350 |

| 5 | BRK | REG | Regular rate at $10 an hour | $50 |

| 10 | TRN | Unpaid | Unpaid | $0 |

| Total: | $400 |

After overtime:

| Hours | Time Code | Hour Type | Rate | Paid |

|---|---|---|---|---|

| 32 | WRK | REG | Regular rate at $10 an hour | $320 |

| 5 | BRK | REG | Regular rate at $10 an hour | $50 |

| 8 | TRN | Unpaid | Unpaid | $0 |

| 3 | WRK | OT1 | Overtime rate at $15 an hour | $45 |

| 2 | TRN | OT1 | Overtime rate at $15 an hour | $30 |

| Total: | $445 |

1b - Overtime rate is less

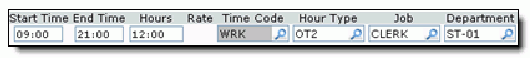

In this example result, the employee works on a special project from 9:00 to 21:00 on Tuesday, Wednesday, and Thursday. The employee is paid double-time as incentive to work on the project.

The employee worked 36 hours (2160 minutes) of eligible time, which is below the first threshold. Since the Assign equal or better hour type to overtime work details check box was selected, the rule does not convert the eligible time within the first threshold to the REG hour type. If the check box was cleared, the rule would convert the first 40 hours of eligible time to the REG hour type.

1c - Employee already paid at overtime

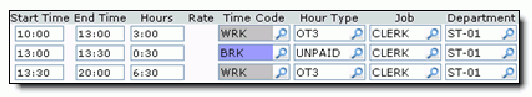

In this example result, the employee works from 10:00 to 18:00 on Monday through Thursday, taking a half hour break each day at 12:00. On Friday, New Year’s Day, the employee works from 10:00 to 20:00, taking a half hour break at 13:00 and is paid double-time and a half for working on a public holiday.

The employee worked 30 hours (1800 minutes) of eligible time. Although the employee worked for 9.5 hours on Friday, the work details are not eligible for overtime because they have the OT3 hour type, which is not one of the eligible hour types. Since the employee did not work beyond the regular rate threshold, the rule does not assign any overtime.