Business Example 2 - Guarantees Plus Rule

This example covers these business needs:

- Employees are guaranteed 50% of their scheduled time each week. Weeks start on Monday, and any guarantee premiums are paid on the following Sunday.

- Regardless of their schedule, if employees work anytime during the week, they are guaranteed at least 10 hours of work. But they are never guaranteed more than 25 hours a week.

- Paid training is considered work and is counted against the amount of time employees are guaranteed.

- One hour of overtime, at time and a half, is counted as 1.5 hours against the guaranteed time.

- Premiums employees earn for working undesirable shifts count against the amount of time employees are guaranteed.

Configuration

Condition: Is Day Condition with Day parameter set to Sunday

Rule parameters:

| Parameter | Value |

|---|---|

| *Time Codes | WRK, TRN |

| Hour Types | REG, OT1 |

| Type of Eligible Detail | option selected |

| *Guarantee Period | option selected |

| Day Week Starts | Monday |

| *Use Guaranteed Minutes from | Scheduled Duration option selected |

| Guaranteed Minutes Multiplier | 0.5 |

| Minimum Guarantee Duration | 600 |

| Maximum Guarantee Duration | 1500 |

| Use effective minutes when calculating eligible minutes | Selected |

| *Premium Time Code | Assign time code option selected with PRM selected from the lookup |

Additional configuration:

In the left pane of the Quick Rule Editor, the option was selected in the Auto Recalc drop-down list.

Results

2a - Employee is paid guarantee premium

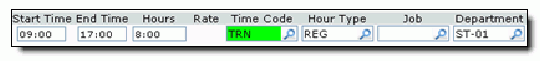

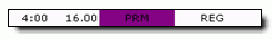

In this example result, the employee is scheduled for 40 hours of training during the week. The employee attends the first two days, for 8 hours each day. The training session was cancelled for the rest of the week.

The employee is paid for 16 hours of training, 4 hours short of the guaranteed 20 hours. Since the Scheduled Duration option was selected, and the rule was configured with a Guaranteed Minutes Multiplier of 0.5, the rule guarantees the employee's 40 scheduled hours multiplied by 0.5.

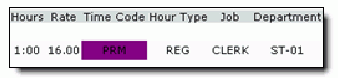

When the rule fires at the end of the week, the rule pays the employee a 4 hour guarantee premium.

2b - Employee is guaranteed the minimum duration

In this example result, the employee is scheduled for 15 hours. On the last day of the week the employee is sent home early, after working 2 hours. The employee worked a 6 hour shift the day before.

The employee worked a total of 8 hours during the week, more than 50% of their scheduled 15 hours. Since the rule was configured with a Minimum Guarantee Duration of 600 minutes, the employee is guaranteed 10 hours and owed a 2 hour premium.

On the last day of the week, Sunday, the rule pays the premium against the employee’s default labor allocations.

2c - Employee is guaranteed the maximum duration

In this example result, the retail employee is scheduled for 60 hours during one week over the Christmas season. The store was over-staffed and the employee was sent home early, working six 4-hour shifts, instead of 10-hour shifts.

The employee worked 24 hours, 6 hours less than 50% of their scheduled time. Since the rule was configured with a Maximum Guarantee Duration of 1500 minutes, the employee is only guaranteed a maximum of 25 hours and owed a 1 hour premium.

On the last day of the week, Sunday, the rule pays the premium against the employee’s default labor allocations.

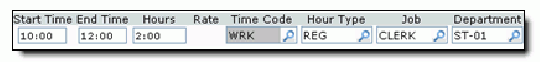

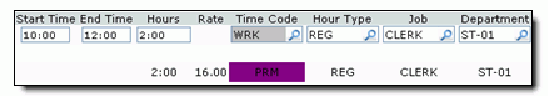

2d - Employee has other premiums and overtime

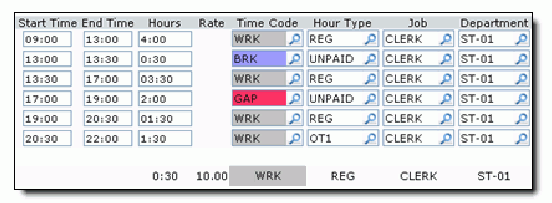

In this example result, the employee is scheduled for 45 hours, working day shifts. The employee agrees to cover some night shifts. On Monday and Wednesday, the employee works the regular 8-hour day shift, and the 3-hour night shift, earning a premium for working nights, and overtime for working more than 9 hours in one day. The employee takes the rest of the week off.

The employee works 10.5 hours each day with a 30 minute, unpaid break. Of the 10.5 eligible hours, 1.5 hours are paid at the overtime rate. The employee also earns a 30 minute premium for working the night shift.

In total, the employee works 21 hours, shorter than the 22.5 guaranteed hours. The rule was configured with the Type of Eligible Detail parameter set to Both, so the rule also counts the 1 hour of premiums the employee earned for working the night shift, bringing the employee’s amount of work up to 22 hours. Also, the Use effective minutes when calculating eligible minutes parameter was selected, so the rule multiplies the 2.5 hour work detail from 20:30 to 22:00 by the related hour type multiplier (1.5 for OT1) on each day. The 5 hours of overtime is counted as 7.5 hours against the employee’s guaranteed time.

The employee’s eligible time during the week is 18 hours of regular time, 5 hours of overtime counted as 7.5 hours, and 1 hour of premiums. In total, the rule counts 26.5 hours against the employee’s guaranteed 22.5 hours. Since the time is over the guaranteed time, the rule does not pay a premium.