Business Example 4 - Weekly Overtime Plus Rule

This example covers these business needs:

- Employees earn overtime after working 80 hours in one pay period.

- Premiums count toward the duration of an employee’s worked time.

- Overtime should be paid on eligible time worked during unscheduled time.

Configuration

Condition: Always True

Rule parameters:

| Parameter | Value |

|---|---|

| Hour Set Description | REG=4800, OT1=9999 |

| Work Detail Hour Types | REG, OT1, OT2 |

| Work Detail Time Codes | WRK |

| Premium Hour Types | REG |

| Premium Time Codes | PRM |

| Eligible Overtime Period | Pay Period |

| Allocate overtime based on the schedule | Selected |

Additional configuration:

The Auto Recalc parameter in the Quick Rule Editor is set to ENTIRE PAY PERIOD.

Results

4a - Employee earns overtime

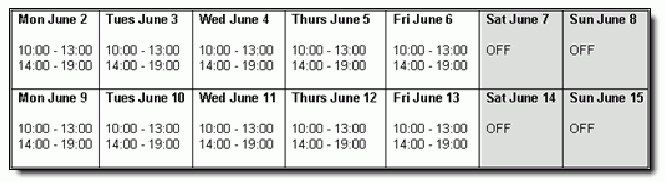

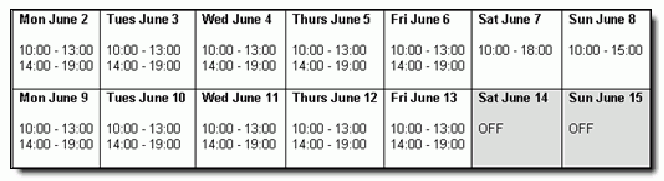

In this example result, the employee is scheduled to work Monday to Friday, from 10:00 to 19:00 each day, with an hour break at 13:00. The pay period starts June 2nd and ends June 15th.

During this pay period, the employee works their regular shifts, plus 8 hours on Saturday June 7th, and 5 hours on Sunday June 8th.

The employee worked 93 hours during the two-week pay period.

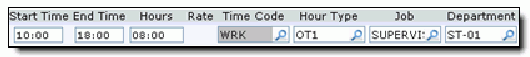

The rule assigns 13 hours of overtime, on a schedule-basis so that overtime is paid to unscheduled time. The employee’s ten regular shifts are paid at the regular rate. The rule then assigns the overtime rate to eligible work on days the employee does not have a schedule. The rule changes the hour type of 8 hours of eligible work on Saturday and 5 hours on Sunday to OT1.

These tables summarize the employee’s pay for the week before and after the overtime is paid.

Before overtime:

| Hours | Time Code | Hour Type | Rate | Paid |

|---|---|---|---|---|

| 93 | WRK | REG | Regular rate at $10 an hour | $930 |

| Total: | $930 | |||

After overtime:

| Hours | Time Code | Hour Type | Rate | Paid |

|---|---|---|---|---|

| 80 | WRK | REG | Regular rate at $10 an hour | $800 |

| 13 | WRK | OT1 | Overtime rate at $15 an hour | $195 |

| Total: | $995 | |||

4b - Employee does not work any eligible time

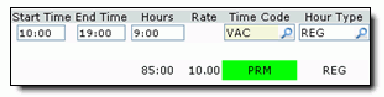

In this example result, the employee is on vacation for two weeks at the end of the year. The employee has met several sales quotas and is paid a yearly bonus at the end of the last two week pay period.

The employee is paid an 85 hour premium, at the regular rate, as a yearly bonus. The rule counts the premium time toward the employee's worked time, so the rule considers the employee has worked 85 hours (5100 minutes) in the pay period, 5 hours (300 minutes) of which is beyond the regular rate threshold. Since the rule does not pay overtime on premiums alone, and the employee does not have any eligible work details during the pay period, the rule cannot assign any overtime.