Business Example 1 - Guarantees Plus Rule

This example covers these business needs:

- Employees are guaranteed 3 hours each shift they work. They can work multiple shifts in one day. Each shift can contain multiple breaks and still be considered part of the same shift, when determining if the employee is owed a premium.

- Any time spent working the CLERK, CASHIER, or OFFICE job counts toward the guaranteed amount of work.

- Employees must work for at least 15 minutes at a time, for the work to count toward the guaranteed amount of work.

- Any premiums employees earn do not count towards the guaranteed amount of work.

- Premiums are paid proportionally against the same jobs the employee worked during the shift with the guarantee premium.

Configuration

Condition: Always True

Rule parameters:

| Parameter | Value |

|---|---|

| *Time Codes | WRK |

| Jobs | CLERK, CASHIER, OFFICE |

| Minimum Detail Duration | 15 |

| Type of Eligible Detail | option selected |

| *Guarantee Period | option selected |

| *Use Guaranteed Minutes from | option selected with 180 specified in the field |

| Consider independent occurrences | Selected |

| Ignore time codes when considering independent occurrences | BRK |

| *Premium Time Code | Assign time code option selected with PRM selected from the lookup |

| Guarantee Labor Settings | Allocate proportionally by job option selected |

Results

1a - Employee is paid guarantee premium

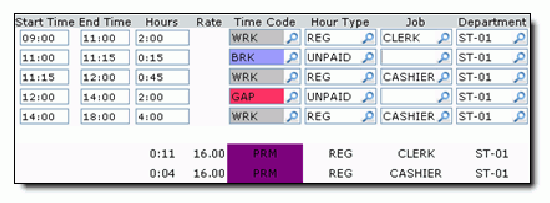

In this example result, the employee works two shifts during the day, from 9:00 to 12:00, with a 15 minute break, and 14:00 to 18:00.

The employee was paid for a total of 6 hours and 45 minutes of work during the day. However, the employee's first shift lasted 2 hours and 45 minutes, 15 minutes short of the guaranteed 3 hours. Since the rule was configured with the Consider independent occurrences check box selected, the rule does not sum the duration of work during the whole day; the rule checks if each grouping of work meets the guaranteed time and finds that the first shift is too short. The rule groups the work between 9:00 to 11:00 and 11:15 to 12:00 together, because the time in between has the BRK time code, listed in the Ignore time codes when considering independent occurrences parameter.

The employee is owed a 15 minute premium (3 hours of guaranteed time, minus the amount of work, 2 hours and 45 minutes). The rule pays the premium, proportionally against both jobs the employee worked during the short shift. The employee worked roughly 72% of the time of the short shift in the CLERK job, so 72% of the 15 minute premium is paid against the CLERK job.

1b - Employee’s shift is too short

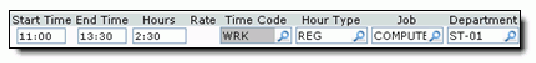

In this example result, the employee’s shift starts at 11:00, but they punch in for work too early, at 9:00. Their supervisor has them punch out, and back in when their shift starts.

The first work detail with an eligible time code and job is shorter than the guaranteed 3 hours, but the rule was configured with a Minimum Detail Duration of 15 minutes, so the rule ignores the work detail. The employee’s actual shift, from 11:00 to 16:00 is longer than the guaranteed amount of minutes, so the rule does not pay a premium.

1c - Employee does not work an eligible job

In this example result, the employee leaves their shift early, and only works 2.5 hours.

Although the employee worked less than the guaranteed amount of time, the employee did not work in an eligible job, so the rule does not pay a premium.