Recording the Principal to Principal Hierarchy

A policy may be underwritten by several different underwriters to spread the risk and the risks may placed in a hierarchical structure. These individual underwriters and this hierarchical structure can be recorded on the detailed claim or premium transactions, posted to the client or underwriter accounts, to enable inquiries, reports and other Financials functions to be carried out based on this information.

Each financial transaction can contain up to 20 hierarchy codes and these define the hierarchical principal to principal structure for the business transaction. These hierarchical codes can only be loaded into Financials using Ledger Import (LIM).

The hierarchy codes from 1 to 20, in order, are used to build the structure.

Hierarchy column 1 always identifies the top level in the structure. For postings to a client account, this top level is always the client account. For postings to an underwriter account, this top level is always the underwriter account.

Hierarchy column 2 identifies the next level down in the structure which identifies the underwriter with overall ownership for the risk. Where this risk has been spread, column 3 identifies the next level of subsidiary underwriters, and so on down the hierarchy.

When the risk for a policy has been spread across a number of underwriters, the value of a claim is posted to the client as several transactions, one for each underwriter identifying the amount of the claim covered by that underwriter. The transactions contain the hierarchy codes required to build the risk structure.

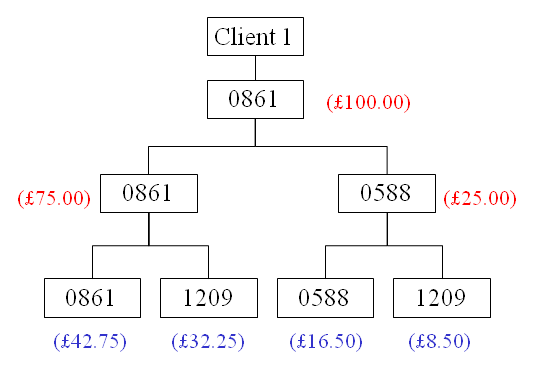

This is best illustrated with an example.

Client 1 has made a claim for GBP100 on a policy that was underwritten by several underwriters. The following transactions are posted to reflect the claim. They include four hierarchy columns, containing the codes shown below.

| Tx Ref | Posting Ref | Account | Amount | Hierarchy Column 1 | Hierarchy Column 2 | Hierarchy Column 3 | Hierarchy Column 4 |

| ABC | 1 | Client 1 | 42.75 DR | Client 1 | 0861 | 0861 | 0861 |

| ABC | 2 | Client 1 | 32.35 DR | Client 1 | 0861 | 0861 | 1209 |

| ABC | 3 | Client 1 | 16.50 DR | Client 1 | 0861 | 0588 | 0588 |

| ABC | 4 | Client 1 | 8.50 DR | Client 1 | 0861 | 0588 | 1209 |

These hierarchy columns details on the transactions are interpreted to build the structure illustrated below.

The claim for Client 1 has been underwritten by three different underwriters: 0861, 1209, and 0588. Underwriter 0861 has overall ownership for the total risk of GBP100. One quarter of this risk (GBP 25) has been underwritten in total by underwriter 0588. This amount, in turn, has been further underwritten by underwriter 1209. Underwriter 1209 has also underwritten part (GBP 32.25) of the remaining (GBP 75) risk owned by underwriter 0861.

The values displayed in blue are those entered on the claim transactions that were input to Ledger Import. The values displayed in red are the consolidated values that are calculated by Financials for various processes, reports and inquiries and represent the total risk owned by different underwriters, at different levels of the risk structure.