GAAP model business unit setup

GAAP (Generally Accepted Accounting Principles), reporting requires the ability to report in a reporting currency converted directly from the original transaction currency and not via another currency.

Take an example of an American owned company that has a division in and operating out of, the UK. This division trades mainly within Eastern Europe.

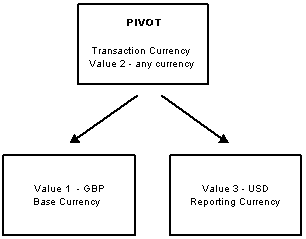

In this instance, you would define the base currency, Value 1, as GBP pounds sterling, the local currency of the division.

You would also have a transaction currency value, Value 2, which is identified as the pivot value. All of the various Eastern European currencies would need to be defined as valid currency codes, and currency rates from each transaction currency, the pivot, to GBP would need to be defined.

Finally, the third currency (Value 3) would be defined as a reporting currency and this would be set to US dollars which is the currency of the head office.

This set up is illustrated below:

The pivot currency is the transaction currency, Value 2. This means that base and reporting currencies are converted from the transaction currency. So, for example, an invoice in Polish zloty would be converted from Polish zloty to the base currency (GBP) and from Polish zloty into the reporting currency (USD).

In financial terms, the US parent company is taking all the risk between the transaction currencies and the reporting currency.

Because in this instance the transaction currency, Value 2, is defined as the pivot, a transaction currency value must exist on every transaction. If a transaction currency value is not entered on a transaction, it defaults to the base currency value entered, and base currency code. The posting rule must be either 'Must be entered' or 'Calculated if not entered'.