Depreciating back-dated expenditures

Work orders are sometimes not closed until after depreciation has been calculated for the period in which the work was completed. Because depreciation has already been calculated, the capital costs from the back-dated work orders are never included in the valuation.

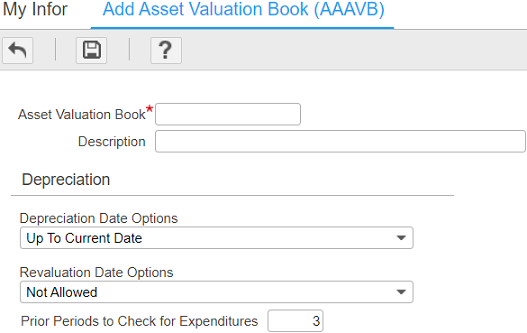

The solution is to recalculate the depreciation adjustments going back to the close date of the work order. Use the new Prior Periods to Check for Expenditures field on the asset valuation book to specify the number of prior periods to consider.

You must also add a formula to the AfterUpdate event of the

WorkOrder object in the Workflow Manager to calculate depreciation for

back-dated expenditures. A new snippet called BackdatingAssetValuation is

provided for this purpose.

For more information see the Infor Public Sector Asset Valuation User Guide.