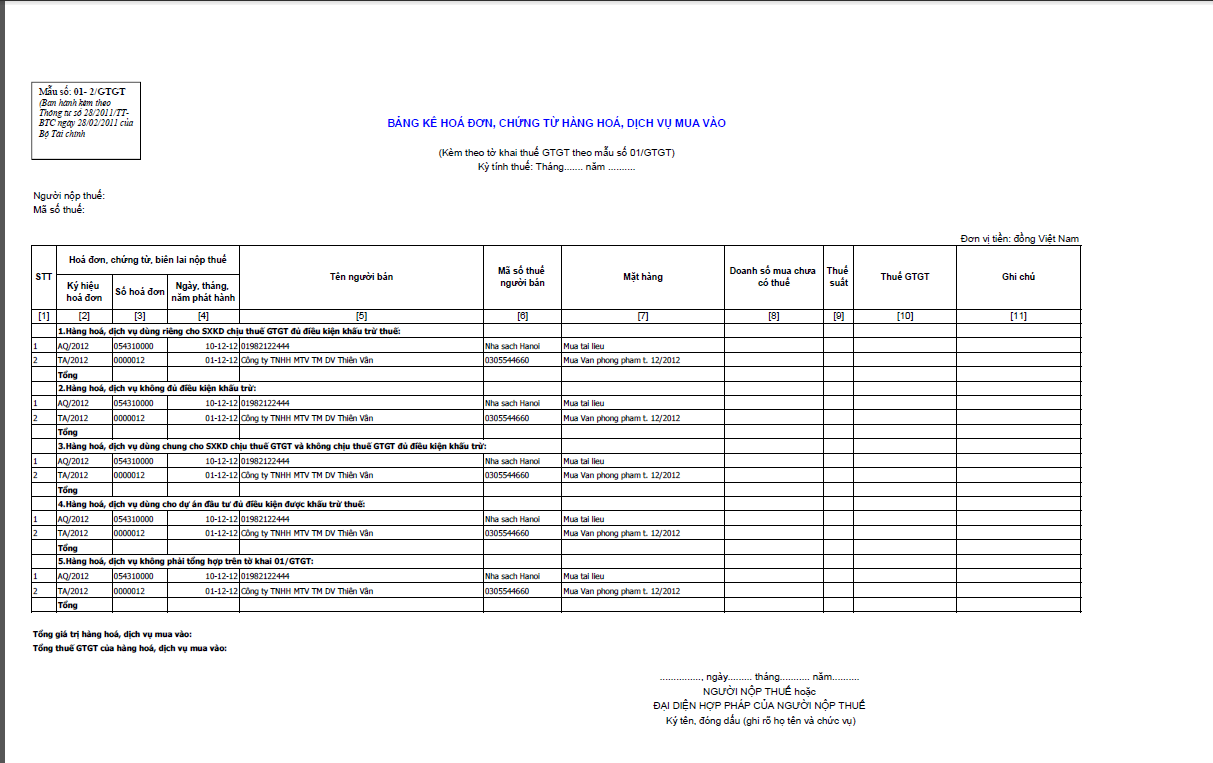

Purchase book for VAT reporting

Requirement

In many countries, a report with all the supplier invoices listed during a period is required. The turnover and the VAT amount per VAT percentage must be specified.

In this country, because of the high demand, each company must produce a purchase book.

M3 solution

This report is produced using the M3 Ad Hoc Reporting tool from the AHR module and Excel in M3. See Configuring information before importing M3 Ad Hoc Reporting templates and Configuration guidelines for ‘Tax Reporting. Open Report Fields’ (TXS035).

Configuration guidelines

The configuration guidelines are the same as for the sales book. See Sales book for VAT reporting.