What Functions Does the Earnings and Deductions Calculation Perform?

Run the Earnings and Deductions Calculation to complete the Gross to Net calculation. The Earnings and Deductions Calculation performs the following in Payroll:

-

Updates deduction code changes to the employee deductions

-

Calculates all current status time records and, optionally, error status time records for the population selected

-

Calculates all one-time deductions in current status for employees with time records

-

Calculates all deductions and wages for all deductions that are valid according to the payment date and deduction cycle selected

-

Updates the payroll history files with the new payroll data (creates records with an open status)

-

Creates payroll distributions for use in creating general ledger transactions

-

Creates a report of all payroll data created

-

Creates a garnishment audit report showing the calculation of any garnishments and informational messages pertaining to the garnishments

-

Creates a funding source report for pension participants

-

Updates the earnings and deductions calculation status flag on payroll cycles status

When processing the Earnings and Deductions Calculation, the time records considered for bypass and delete are only those records that cause the application to halt processing. Records that can cause the application to halt processing are those with incorrect tax categories or incorrect tax mapping to the tax engine.

Example

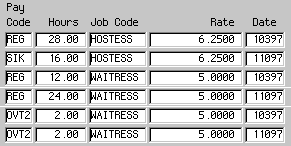

The following time records were created in Payroll for Janet Filman.

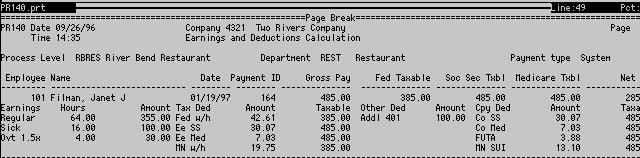

When the payroll manager processed the Earnings and Deductions Calculation, the following earnings and deductions were created for Janet.

Payroll assigns the temporary number under the payment ID field. In this example, 164 is the temporary number assigned by Payroll for Janet Filman.