FLSA overtime calculation

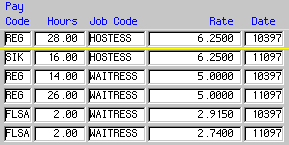

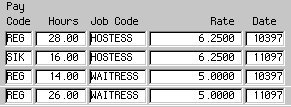

The payroll clerk at Two Rivers enters the following time records for Janet.

Janet is assigned the Bi-weekly Non-Exempt pay plan, which defines the regular hours in a work period as 40 and the overtime premium rate as 50 percent.

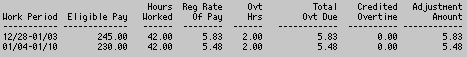

When the payroll manager processed the Overtime Calculation in update mode, the following calculation was completed for the work period ending January 3, 2001:

-

Eligible Wages = 245.00

Eligible Hours = 42

-

245.00 / 42 = 5.83 average weighted rate of pay

-

42 - 40 = 2 overtime hours

-

5.83 x 50% x 2 = 5.83 overtime pay

-

Premium Credit = $0.00

-

5.83 - $0 = 5.83 overtime due the employee

The following calculation was completed for the work period ending January 10, 2001:

-

Eligible Wages = 230.00

Eligible Hours = 42

-

230 / 42 = 5.48 average weighted rate of pay

-

42 - 40 = 2 overtime hours

-

5.48 x 50% x 2 = 5.48 overtime pay

-

Premium Credit = 0.00

-

5.48 - $0 = 5.48 overtime due the employee

Therefore, the following FLSA time records were created for the overtime due to the employee: