Uses for the payment date on Earnings and Deductions Calculation

When you process the Earnings and Deductions Calculation, you select the payment date to print on the payments given to employees. This payment date not only prints on the payments, but is also used for the following:

-

To post cash and employee deduction accruals to the GLTRANS (UNIX/Windows) DBGLGTR (IBMi) file

-

To store payroll history for use in reporting of wages

-

To verify which deductions are valid for the pay cycle

Note: For the application to take the one-time deduction, the one-time deduction date must be less than or equal to the payment date. -

To determine which one-time deductions to take in a pay cycle

-

To calculate MTD (month to date) and monthly limits on deductions

-

To verify which Direct Deposit distributions are valid for an employee

Example

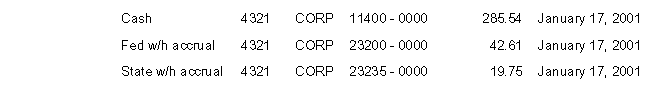

The payment created for Janet is dated January 17, 2001.

Therefore, general ledger postings are created as follows:

When running tax reports, these wages are included in the first quarter of 2001. More specifically, these wages are stored in history with a date of January 17, 2001.

Only deductions with an effective date range that including January 17, 2001(and are flagged for the specified deduction cycle) are taken.

Janet has two one-time deductions to take an additional amount of 401(k) at two specific times this quarter. Both are in Current status with dates of January 1, 2001 and February 1, 2001. Only the first one-time deduction is taken in this cycle.

Only Direct Deposit distributions that have an effective date range that includes January 17, 2001 (and are flagged for the specified deduction cycle) are used for automatic deposit distributions.