Chart of accounts

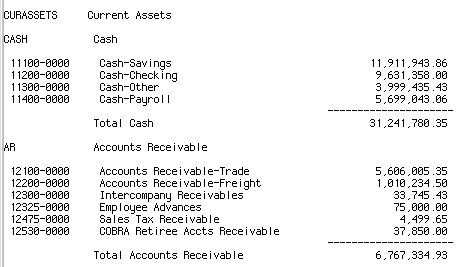

A chart of accounts is the list of all of the accounts that you use to organize your accounting records. It is made up of balance sheet accounts (assets, liabilities, and equity) and income statement accounts (income and expenses). The balance sheet and income statement accounts are made up of summary and detail accounts.

Uses of chart of accounts

The chart of accounts is used to post journal entries and to summarize general ledger information for reports and inquiries. The account numbers and descriptions that you define are reflected in your balance sheets, income statements, and other reports and inquiries. Detail accounts roll up into summary accounts to provide totals.

Company structure considerations

You can assign the same chart of accounts to more than one company, or assign different charts of accounts to different companies. Although each general ledger company can use only one chart of accounts to create and post journal entries, it can use different charts of accounts for reporting purposes. For example, you can define a chart of accounts to use exclusively with Report Writer.

If your organization has multiple locations, then consider whether each location is better defined as an accounting unit or as a subaccount. To print financial statements by location, it is recommended to define a location as an accounting unit. See Defining a company.

If you are using a single chart of accounts across companies, then you force consistent summary account usage in the companies. If you need to produce consolidated financial reports for multiple companies, then you must use the same chart of accounts for the companies that you want to consolidate.

If you assign different charts of accounts to different companies, name or number accounts consistently for easier reporting across companies.

Statutory chart mapping

Statutory accounts are accounts that have predefined numbers where the sequence of digits indicates the structure of the account. Each account has a description in local currency that must appear on reports that are due periodically, annually, or both.

Some countries, specifically France, require that company reporting practices conform to a predescribed and statutory chart of accounts. The chart mapping process provides intracompany chart mapping capability from a company chart detail account to an account in a statutory chart. The intracompany chart mapping process will be used to generate standard financial reports for the French market.