eInvoicing

All European public administrations must be able to accept invoices in electronic format from their suppliers, in compliance with the European standards approved by CEN: UN/CEFACT XML and UBL. Some countries have created their own national platforms to centralize the receipt of invoices from suppliers and others have opted to use the European PEPPOL network in preference for these B2G exchanges.

The invoices can be in one of these standards:

- Peppol BIS, based on the UBL standard

- CII, the UN/CEFACT XML

Invoices and credit notes based on these standards can be created according to country specifications of the destination country. For details of which countries are supported, see Infor Localization Services Product Overview.

PEPPOL UBL invoices and credit notes are generated according to the BIS rulebook and sent to the configured access provider. This can be done automatically though ION API or manually.

CII invoice and credit notes are generated in the UN/CEFACT XML.

Some country-specific information is required for some countries.

For details of supported countries and versions, see Infor Localization Services Product Overview.

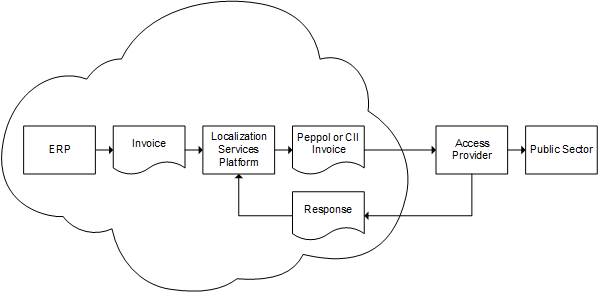

This diagram and list show the flow of data between ERP and customer:

- The ERP publishes a standard sale invoice or credit note.

- LSP determines the proprietary format for the invoice, based on information sent from the ERP and Master data configured in LSP.

- The proprietary format is created, validated against specific country rules, and then sent to the Access provider.

- The access provider acknowledges receipt of the invoice and forwards the invoice to the customer.

- The response status is updated within Localization Services.