LSP Translations

These are the translations required in this release:

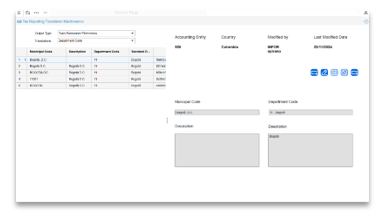

Department Code & Municipal Code

Location data used in ERP needs these translations, to make possible assemble correctly the directions in the Invoice xml file sent to third party software. The data from the ERP which will be translated refers to Business Partner/Company record > Address Record > Invoice Record.

In LN, if City COL-11-Bogotá is associated with a specific business partner, translations must be specified in the LSP:

For Department Code:

- Bogotá – 11

- 11001 (Bogotá DANE Code) – 11

For Municipal Code:

- Bogotá - 11001

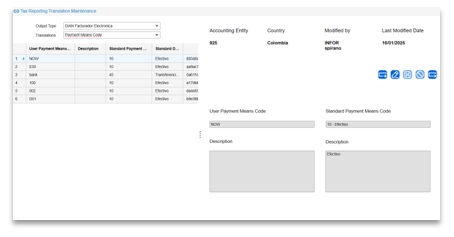

Payment Means Code

This information refers to the Payment Terms, within the Invoice.

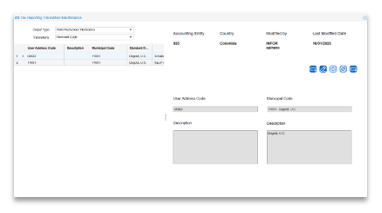

Tax Code

The withholding tax codes in Colombia localization are maintained in the Withholding Tax Codes (lpcol0104m000) session. When BOD assembles the file to be sent to LSP, the prefix “CO_W” is added to the withholding tax code used in the commercial operation. The translation in LSP consists in adding the prefix to the withholding tax code created in the ERP.

Example:

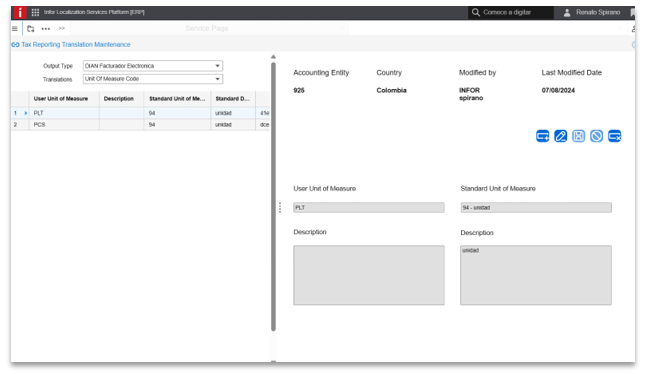

Unit of Measure Code

The units of measure used in items and orders or invoices in LNCE also needs to be translated to a Unit of Measure that matches the DIAN specific table.