Overall Flow for Sales Order Invoices

Also, together with BP and Ship-To Address, the Source Order Type (Sales Order, in this case) is used, in addition to the Classification Sales.

The item from the Sales Order line completes the required information to retrieve the first level of search which is the Commercial Activity. After the completion of the first level of search, the system searches for the tax codes associated with this set of information.

All of this data is stored in the Invoice Line Composing (lpcol242) table and is used later in CI, when composing an invoice.

When composing an invoice in CI, the snapshot of the configuration is used to retrieve the withholding tax calculation parameters, the third level of search.

After this operation, the withholdings are finally calculated and stored on Customer Withholding table (lpcol208). This table is used later to update the information in BOD (when eInvoicing is being used) and in Finance (transactions), to make the accounting of the withholdings in Colombia.

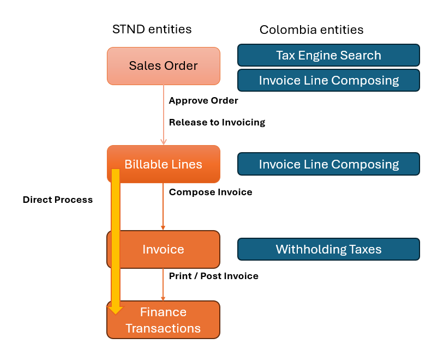

This is the overview process using Sales Orders in Colombia Localization: