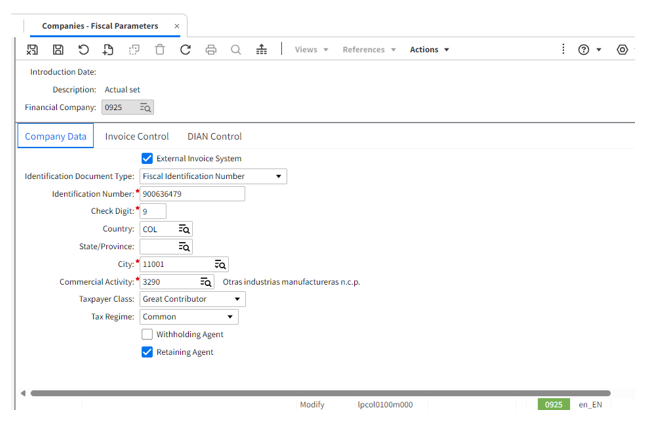

Companies – Fiscal parameters

Identification is required:

- Financial company; Company number

- External Invoice System; indicates whether eInvoicing functionality is implemented

- Identification document type; Company Fiscal ID

- Identification number; corresponds to the number issued by the DIAN to the company in the RUT (Registro Único Tributario).

- Check Digit; number assigned by the DIAN (algorithm) which is also found in the RUT (Registro Único Tributario).

- Country

- State or Province

- City; Code of the city where the economic activity is carried out, according to DIAN codification.

- Commercial Activity; Code that applies according to the commercial activity to which the company is dedicated, coded according to the municipality.

- Taxpayer class; Classification assigned by the DIAN, according to the tax obligations to be fulfilled (Large taxpayer, Legal Entity, Natural Person), according to criteria such as income, number of employees, etc.

- VAT Regime; Classification assigned by the DIAN, according to the tax obligations that the company must comply with regarding the Value Added Tax VAT, (Common, Simplified).

- Withholding agent; legal or natural person authorized by law to make withholding, corresponds to sales operations or provision of services.

- Retaining agent; legal or natural person authorized to apply withholdings and applies to who pays, which means who buys.

- Control Year Supplier Invoice: When this field is checked, the system checks the entry of the date of the purchase invoice, validating that the year of the document corresponds to the current fiscal year.

- Control Period Supplier Invoice: When this field is checked, the system checks the entry of the purchase invoice date, validating that the period (month) of the document corresponds to the current period, this will depend on the status of the periods.

- Withholding Decimals: Validates the decimals according to the currency and takes into account these definitions for the calculation of withholdings.

- DIAN Agency ID; Future use.

- DIAN Agency Name; Future use.

- DIAN Scheme URI; Future use.

- DIAN Software Provider NIT; Future use.

- DIAN Software Provider NIT Verification Code; Future use.

- DIAN Scheme Agency ID; Future use.

- DIAN Scheme Agency Name; Future use.

- DIAN Scheme Name; Future use.

- DIAN Software ID; Future use.

- DIAN Software Security Code; Future use.

- DIAN NIT; Future use.

- DIAN NIT Verification Code; Future use.

- DIAN URL for QR Code; Future use.

- UBL Version ID; Future use.

- Operation Type; Future use.

- Document Version; Future use.

| Code | Description | Path |

|---|---|---|

| Companies - Fiscal Parameters (lpcol0100m000) | Companies – Fiscal Parameters | Localization/Colombia/Master Data/Withholding Management/ Companies – Fiscal Parameters |