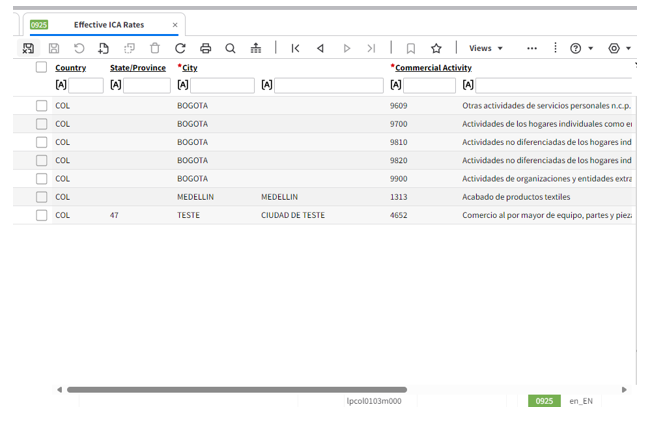

Effective ICA rates

Each municipality is assigned the corresponding commercial activity, detailing the applicable ICA rate (tariff) and the amounts from which this tax is applied.

Fields:

- Country

- State/Province

- City: DANE/DIAN code of the city and its corresponding name.

- Commercial Activity: Code of the economic activity and its description according to the resolution of the corresponding municipality.

- Effective Date: Date from which the definition can be applied.

- ICA Rate: Rate or percentage to be applied.

- Minimum Tax Base Amount: Minimum value to apply the withholding.

| Code | Description | Path |

|---|---|---|

| Effective ICA Rates (lpcol0103m000) | Effective ICA rates | Localization/Colombia/Master Data/Withholding Management / Effective ICA rates |

City: 11001 BOGOTA

Activity: 0161 Other industrial activities

Rate: 9.66%, (9.66x1000; rate defined in the Resolution)

Limit: 0

In this example, it defines that for any purchase or sale made in Bogota for an amount greater than or equal to $0, a 9.66% ICA tax will be paid.