Print Withholding Analysis

This report prints the withholdings for the different withholdings codes, following the

selection made.

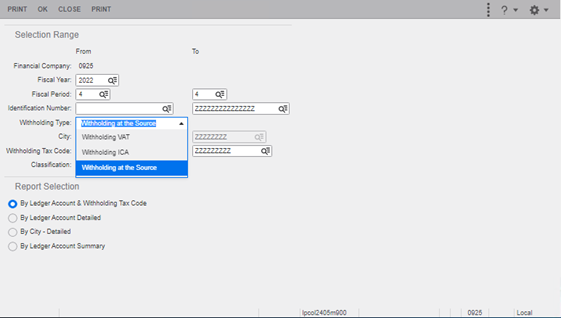

Fields:

- Financial company: The field is only informative, it shows the current financial company where the report is generated.

- Year: Year applicable for the report. Zoom to Fiscal years (tfgld0556m000) session.

- Period: Range of the fiscal period for the report. Zoom to Periods (tfgld0105m000) session.

- ID number: If the user wants to see the withholdings of a specific business partner, it is possible to select a specific tax ID number. Zoom to Business Partner Colombia Tax Information (lpcol0108m000) session.

- Withholding Type: The category corresponding to the withholding, i.e.: Withholding at Source, VAT Withholding or ICA Withholding.

- City: The city code for the ICA withholding report according to the city where the withholding was made.

- Withholding code: You can select a range of codes or a specific withholding code according to the type to generate the report.

- Classification: Here it is necessary to select whether to list withholdings according to origin; purchases or sales.

| Code | Description | Path |

|---|---|---|

| lpcol2405m900 | Print Withholding Analysis | Localization/ Colombia / Auxiliary Reports/ Print Withholding Analysis |

The following reports can be printed:

- By account and withholding code

- By account - Detailed

- By City - Detailed

- By account - Summarized

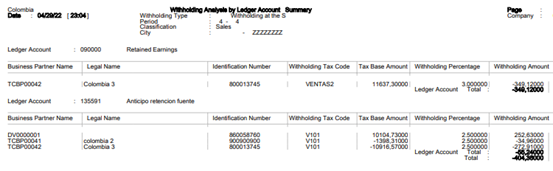

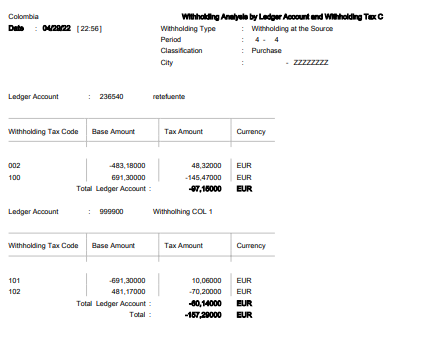

By Account and Withholding Code

The summary report prints the total of an account and a withholding code.

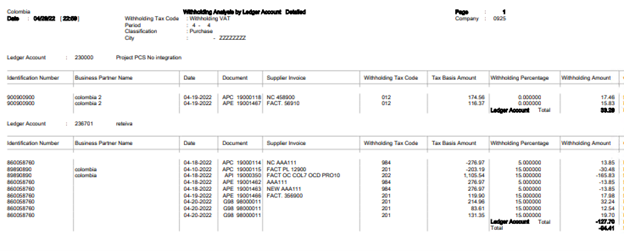

By Account - Detailed

This report prints the withholdings by account and document.

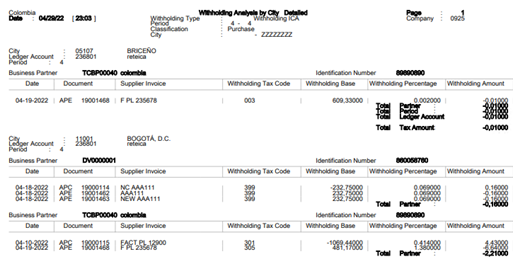

By City - Detailed

This report prints the withholding data by city, account, Partner and period, listing all documents.

By Summarized Account

The summary report shows the total by account and Partner, without detailing the documents.