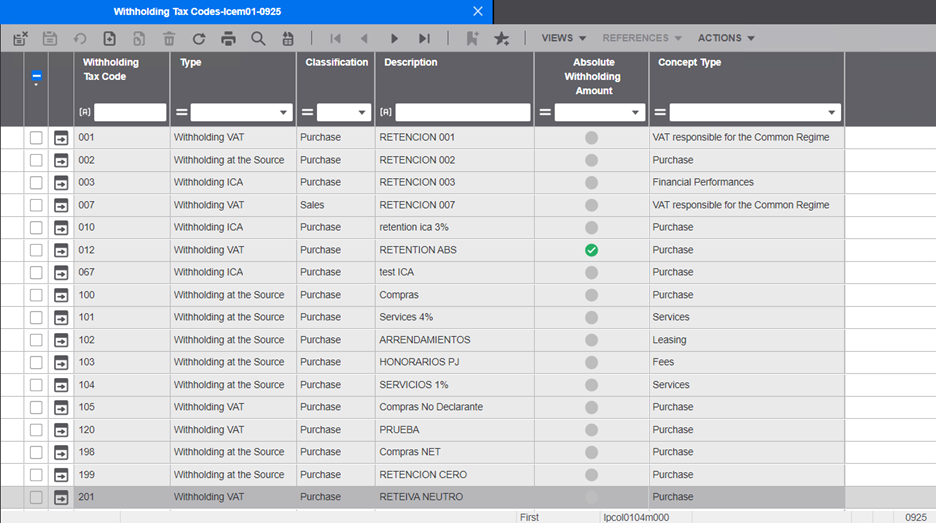

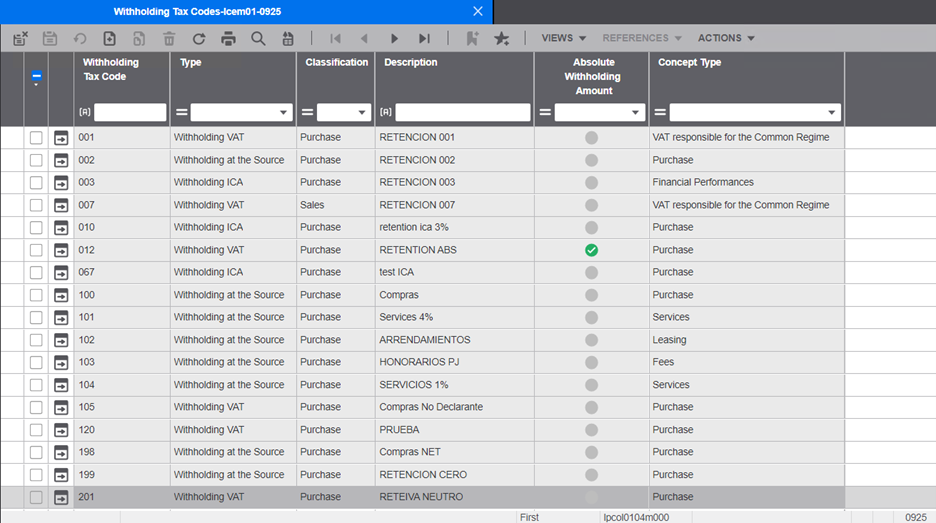

Withholding Tax Codes

Corresponds to the codes of the different withholding concepts (VAT, ICA, Source, Stamp),

applicable to purchase or sale transactions. For each withholding concept, its calculation

basis is defined (gross value, net value or VAT value), and the amount from which it applies

and the concept.

Fields:

- Withholding Tax Code: Numeric or alphanumeric code assigned by the user.

- Type: Type of withholding; Withholding at source, VAT withholding, ICA withholding.

- Classification: Purchase or Sale

- Description: Name corresponding to the withholding code

- Absolute Withholding Amount: Withholding type that does not require percentage (rate).

- Type of concept: Description of the withholding concept

| Code | Description | Path |

|---|---|---|

| lpcol0104m000 | Withholding Tax Codes | Localization/Colombia/Master Data/Withholding Management / Withholding Tax Codes |

To define details of the withholding code, fields:

- Effective Date: Date from which the withholding is to be applied

- Base Percentage: percentage corresponding to the base value to apply the withholding.

- Rate: percentage of the withholding

- Minimum Limit: Minimum value to apply the withholding

- Base Value Type: Classification of the base on which the

withholding is to be applied according to its concept, as follows:

- Gross Value: Indicates calculating the tax before VAT.

- Net Value: Indicates to calculate the tax including VAT.

- VAT Value: Indicates that the base for the tax calculation is VAT.

- Operation type: Corresponds to the operation to be performed by the withholding code; subtract, add or neutral.

- Debit account and description: Debit account code and description to which the value of the calculated withholding will be posted.

- Credit account and description: Credit account code and description to which the calculated withholding value will be posted.