Using dummy accounts

Using dummy statement accounts to get correct level codes

To set up a statement account structure, you can use parent-child relations. In such a structure, one parent can have several children. However, the parent does not need to be every child's direct parent. The parent can be on the level directly above the child, but there can also be one or more additional levels between parent and child.

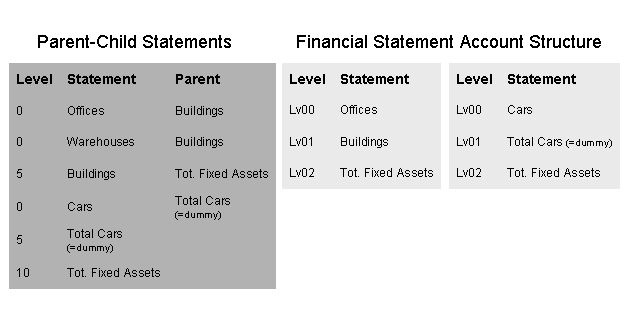

In the example below, 'Total Fixed Assets' is the direct parent of 'Cars'. 'Total Fixed Assets' is also parent of 'Offices' and 'Warehouses'. However, there is another parent in between, namely 'Buildings'. When the statement account structure is exported to the FST reporting tables, parent 'Total Fixed Assets' will be on level Lv02 for children 'Offices' and 'Warehouses', and on level Lv01 for child 'Cars'.

If you create a report using an external report writer, and you want to use parent 'Total Fixed Assets' to totalize the financial values of children 'Offices', 'Warehouses', and 'Cars', a problem occurs. Because 'Total Fixed Assets' is stored with different level codes (Lv01 and Lv02), the external report writer does not know whether to totalize Lv01 or Lv02. To avoid this problem, you must use dummy statement accounts when setting up the statement account structure.

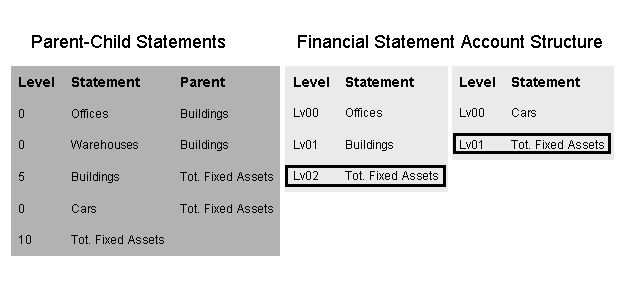

In the example below, a dummy statement account 'Total Cars' is included as an extra level between parent 'Total Fixed Assets' and child 'Cars'. When the statement account structure is copied to the FST reporting tables, the dummy statement account ensures that parent 'Total Fixed Assets' is on the correct level (Lv02). If an external report writer then uses 'Total Fixed Assets' to totalize financial values, 'Offices' and 'Warehouses' as well as 'Cars' are taken into account.