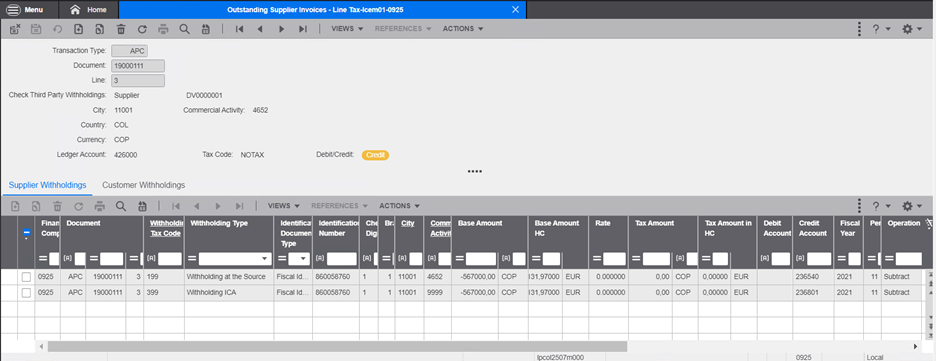

Outstanding Supplier Invoices – Line Tax

This query shows in detail the withholdings applied per document.

Fields:

- Transaction Type: Transaction type code.

- Document number: Transaction number, consecutive.

- Line: Number of the line inside the record or document.

- Partner: BP code.

- City: city code.

- Economic activity code: ISIC code.

- Country: country code.

- Currency: record currency.

- Accounting account: registered in the line.

- Tax code: VAT code.

- Debit/Credit: If the account has debit or credit application.

- Withholding Code: code of the withholding applied .

- Withholding Type: Classification of the withholding.

- Document type: Tax ID type of the partner.

- Tax ID Number: Partner's tax ID number.

- Check Digit: Verification digit.

- Branch: Branch number.

- Currency: Currency or currency of record.

- Base Value: Base amount for withholding in the currency or currency of registration.

- DP Base Value (1): Base amount for the withholding in the company's own currency.

- DP Base Value (2): Base amount for the withholding in the company's currency two (2).

- DP Base Value (3): Base amount for withholding in company currency three (3).

- Percentage: Rate or percentage of withholding applied.

- Tax Value: Calculated amount of the withholding in the currency or currency of record.

- PD Tax Value (1): Calculated withholding tax amount in the company's own currency.

- DP Tax Value (2): Calculated amount of withholding tax in the company's own currency (2).

- PD Tax Value (3): Calculated amount of withholding tax withheld in company currency three (3).

- Debit Account: Code of the debit accounting account.

- Credit Account: Code of the credit accounting account.

- Fiscal year: Fiscal year

- Period: Fiscal period

- Transaction Type: Type of mathematical operation that performs the withholding, addition, subtraction or neutral.

- Transaction Date: Document date

- Dimension 1, 2,3,4,5...: Dimension Code.

| Code | Description | Path |

|---|---|---|

| lpcol2507m000 | Outstanding Supplier Invoices – Line Tax | Localization/ Colombia / Inquiry / Outstanding Supplier Invoices – Line Tax |