Print VAT Analysis – Purchase/Sales

This session allows you to print the VAT tax analysis according to the classification of

Colombia and configured in the system.

Fields:

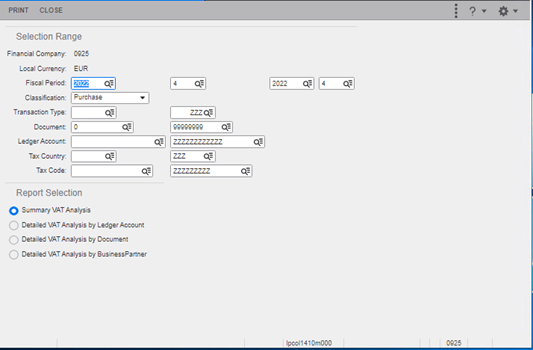

- Financial company: The field shows the current financial company where the report is generated.

- Currency: The field shows the local currency of the company.

- Type of period: Fiscal.

- Year: Applicable year for the report. Zoom to Fiscal years (tfgld0556m000) session.

- Period: Fiscal period range for the report. Zoom to the Periods (tfgld0105m000) session . You must zoom to the corresponding record, taking into account the Period type field.

- Counterfeit: Tax origin; Purchases or Sales.

- Transaction type: Range for transaction types. Zoom to Transaction types (tfgld0511m000).

- Document: Range for the document number. Zoom to Document History (tfgld1504m000) session.

- Accounting account: Range or account to be listed. Zoom to Chart of Accounts (tfgld0508m000) session.

- Tax country: Range for the country.

- Tax code: Range for the VAT tax code. Zoom to Tax codes by country (tcmcs0536m000) session. Displays the tax codes for the country Colombia.

| Code | Description | Path |

|---|---|---|

| lpcol1410m000 | Print VAT Analysis – Purchase/Sales |

Localization/ Colombia / Auxiliary Reports / Print VAT Analysis – Purchase/Sales |

The following reports can be printed:

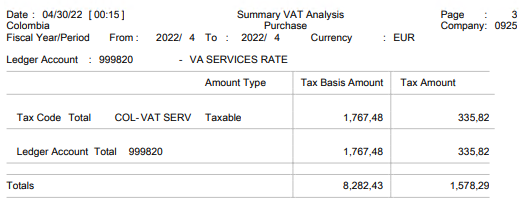

- Summarized VAT Analysis

- Detailed VAT analysis by accounting account

- Detailed VAT analysis by document

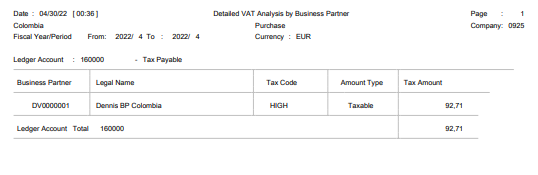

- Detailed VAT analysis by Partner