Tax Regimes

Corresponds to the coding of the different types of Tax Regimes (applied to taxpayers in

Colombia).

This functionality defines the default withholdings to be applied in these regimes. For

Example:

- Large Self-withholding Taxpayer Regime.

- Large Taxpayer Non Self-withholding Regime

- Common Regime

- Simplified Regime

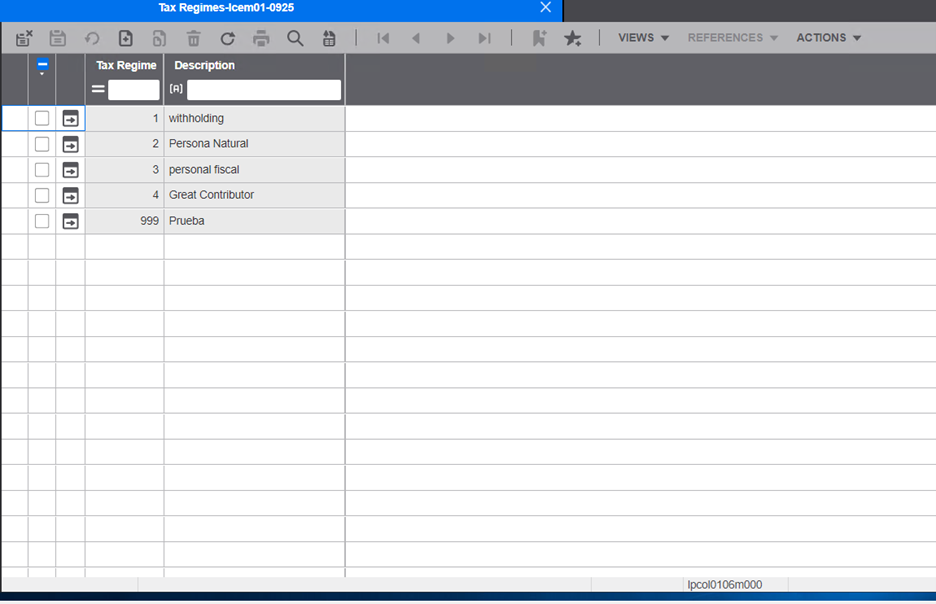

Fields:

- Regime: Numeric or alphanumeric code.

- Description: Name of the Regime corresponding to the code.

| Code | Description | Path |

|---|---|---|

| lpcol0106m000 | Tax Regimes | Localization/Colombia/Master Data/Withholding Management/ Tax Regimes |

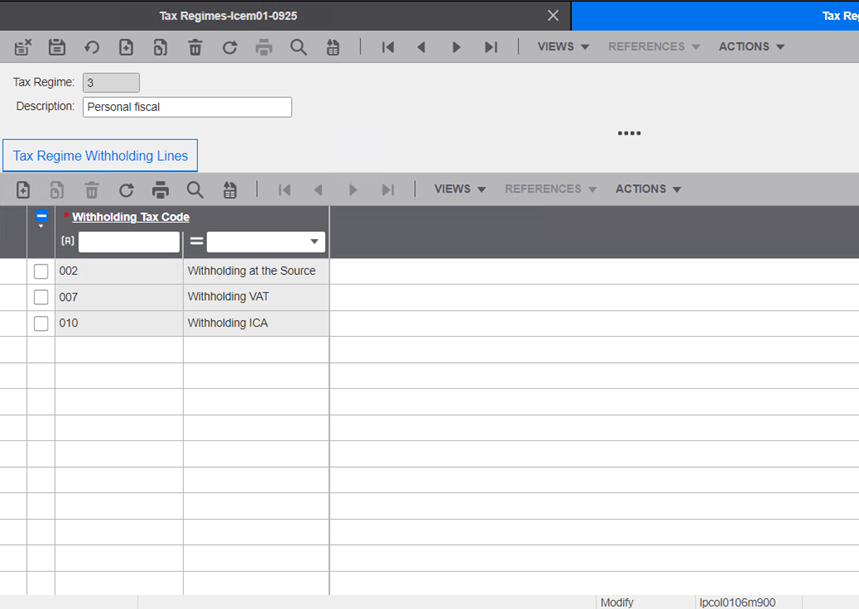

Data to be defined, fields:

- Regime: Code and description of the Regime created in the previous screen.

- Withholding Code: Withholding code, predetermined for this tax regime code.

- Withholding code classification: Type of withholding; Withholding at source, VAT withholding, ICA withholding.