Of the Partners

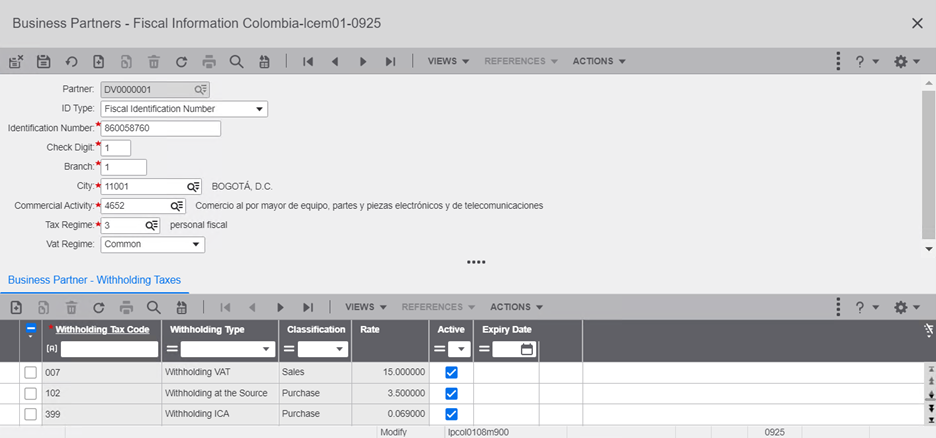

In the creation of Partner; a new session is used to indicate the fiscal data, the predefined withholding codes applicable to the transactions will also be defined, which, previously must be parameterized, allowing the calculation of all taxes according to the tax characteristics of each one.

In the case of the NIT, the verification digit must be entered, which will be validated by means of the corresponding verification algorithm.

The code of the city and the commercial activity is also assigned for the calculation of the ICA withholding.

Identification is required:

- Partner: Standard session Partner Code tccom4500m000

- Type of document: NIT, citizenship card, foreigner's card, etc., identification of the third party to report exogenous information.

- Identification number: Tax identification number of the third party (RUT).

- Verification digit: number assigned by the DIAN (algorithm) that is also found in the RUT.

- Subsidiary number: branch office number

- City: City code where the economic activity is carried out, according to DIAN codification.

- Commercial activity; Code that applies according to the commercial activity in which the Partner engages, coded according to the municipality.

- Regime; Tax regime code, according to the tax classification of the Partner, which contains predefined withholding codes

- Common regime; VAT regime, if the Partner is responsible for VAT.

- Withholding Codes; Numeric or alphanumeric code defined for each type of withholding and concept. This data is previously defined.

- Type of withholding; Corresponds to the classification according to the type of withholding; Withholding at Source Withholding on VAT or Withholding for ICA.

- Classification; According to the operation in which it is used (purchases or sales).

- Rate; Percentage of withholding to be applied on the base value of the tax, and whether it is for purchases or sales.

- Active; If this code is currently active for application in the Partner.

- Date deactivated; Date on which the code was deactivated in the Partner to be applied to transactions that include this third party.

| Code | Description | Path |

|---|---|---|

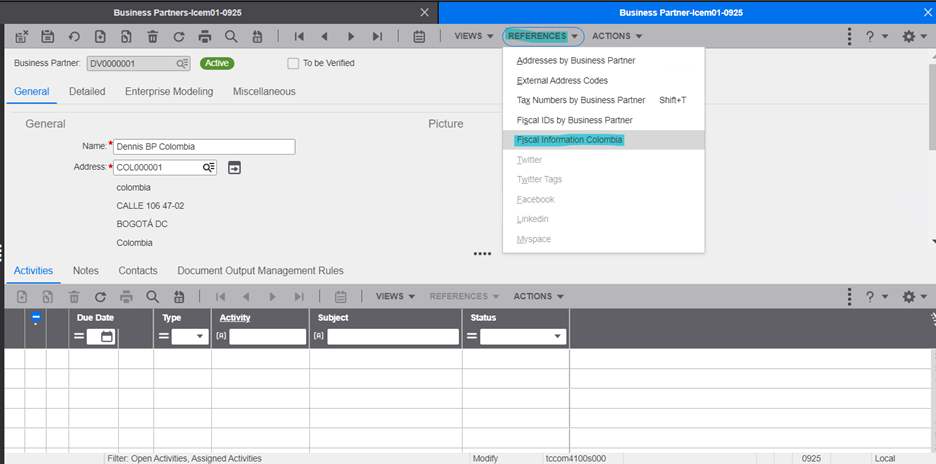

| lploc0108m900 | Business Partner – Fiscal Information Colombia | Master Data /Partners/Partners; References, Fiscal Information Colombia: Business Partner – Fiscal Information Colombia |

From the tccom4500m000 session, choose the record and enter the line.

Next, the subsession tccom4100s000 is displayed and through the References option, the session lploc0108m900 is displayed, where we enter the fiscal data for the Partner.