Chart of accounts – Additional Data Colombia

Conceptual framework

The Single Chart of Accounts, Decree 2650 of 1993, seeks uniformity in the recording of economic operations carried out by merchants, in order to allow transparency of accounting information and therefore, its clarity and reliability.

It is composed of a Chart of Accounts, the description and dynamics for the application of the same, it contains the ordered and classified relation of the classes, groups, accounts and sub-accounts of Assets, Liabilities, Equity, Income, Expenses, Cost of Sales, Production or Operating and Order Costs.

Any report or presentation of accounting information to the administrators, partners, the State and third parties in Colombia, must be made using the numerical codes and denominations indicated in the PUC.

- Class: The first digit.

- Group: The first two digits.

- Count: The first four digits.

- Subaccount: The first six digits.

- Class 1: Assets.

- Class 2: Liabilities.

-

Class 3: Equity.

- Class 4: Income.

- Class 5: Expenses.

- Class 6: Cost of Sales.

- Class 7: Production or Operating Costs.

- Class 8: Memorandum Accounts Receivable.

- Class 9: Memorandum Accounts Payable

Classes 1, 2 and 3 comprise the accounts that make up the Balance Sheet; Classes 4, 5, 6 and 7 correspond to the accounts of the Statement of Profit or Loss or Income Statement and Classes 8 and 9 detail the Memorandum Accounts.

Scope

Define the third party handling for each transaction account, to ensure that the information is stored in the system with the Partner's Fiscal ID.

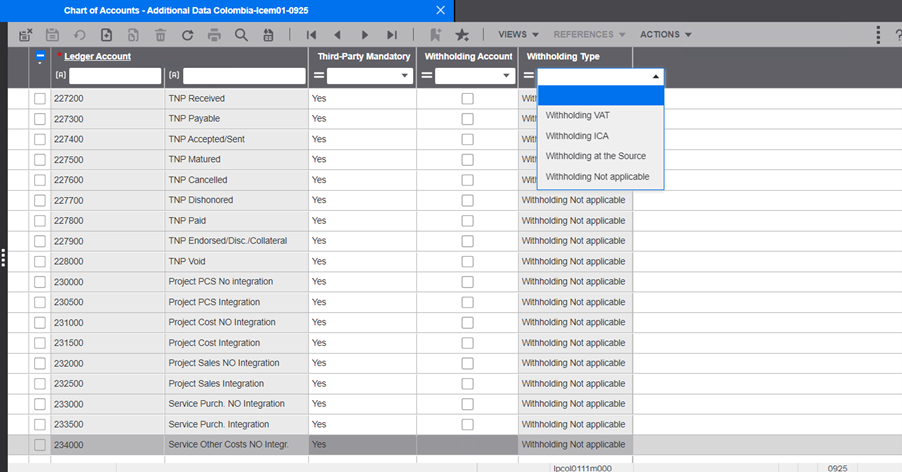

- Accounting account and description: Account code according to account catalog and its corresponding name.

- Mandatory Third Party: This field is set to Mandatory by default, in order to convert the Partner's information to the third party identification of the transactions.

- Withholding Account: Checked if the account code corresponds to an account that handles withholding.

- Withholding Type: Classification of the type of withholding that corresponds if the account applies to a withholding concept. Definir el manejo de tercero por cada cuenta de movimiento, para garantizar que la información quede almacenada en el sistema con la identificación fiscal del Partner.

| Code | Description | Path |

|---|---|---|

| lpcol0111m000 | Chart of Accounts- addiotional Data Colombia | Localization/Colombia/Master Data/Withholding Management/ Chart of Accounts- addiotional Data Colombia |

Zero level accounts 0, are automatically created in this session.