Rejecting a Supplier Invoice (Notifica di Scarto Estio a PA)

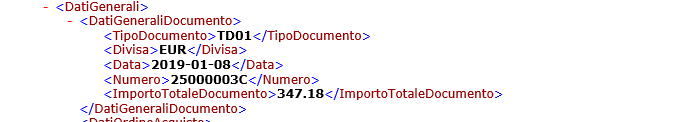

The XML you receive from SDI contain details similar to this:

To respond to this invoice, you need to perform these steps

-

Create an XML file called ITAAAAAAAAAAA_BBBBB.xml where:

- the As are your TaxID.

- the Bs are the sequence number from your Supplier Invoice.

For example: IT1234567890_A0005

-

Copy this template into your XML file:

<xml version="1.0" encoding="UTF-8"?><tns:InvoiceStatusResponse xmlns:tns="http://www.infor.com/InforSdiPurchase" xmlns:xsi="http://www.w3.org/2001/XMLSchema-instance" xsi:schemaLocation="http://www.infor.com/InforSdiPurchase InforSdiPurchase.xsd "><tns:TaxPayerId>AAAAAAAAAAA</tns:TaxPayerId><tns:SupplierTaxPayerId>AAAAAAAAAAA</tns:SupplierTaxPayerId><tns:SupplierInvoiceNumber>CCCCCCCCCCCC</tns:SupplierInvoiceNumber><tns:InvoiceDate>YYYY-MM-DD</tns:InvoiceDate><tns:InvoiceStatus>REJECTED</tns:InvoiceStatus><tns:DocumentType>TD01</tns:DocumentType><tns:Note>The invoice was accepted</tns:Note><tns:MessageId>INFOR0001</tns:MessageId></tns:InvoiceStatusResponse> -

Edit the contents of the XML:

- Replace the As with your Tax ID, without the IT prefix.

- Replace the Cs with the invoice number you are rejecting. The invoice number can be found in the <numero> element.

- Replace the Invoice Date with the date you are rejecting. The invoice date can be found in the <data> element.

- Save the XML.

-

Copy the XML into the Purchase/Outbox folder of the tax

connector.

The revised XML is processed and if successful, returns a status saying the task is completed.