Solution overview

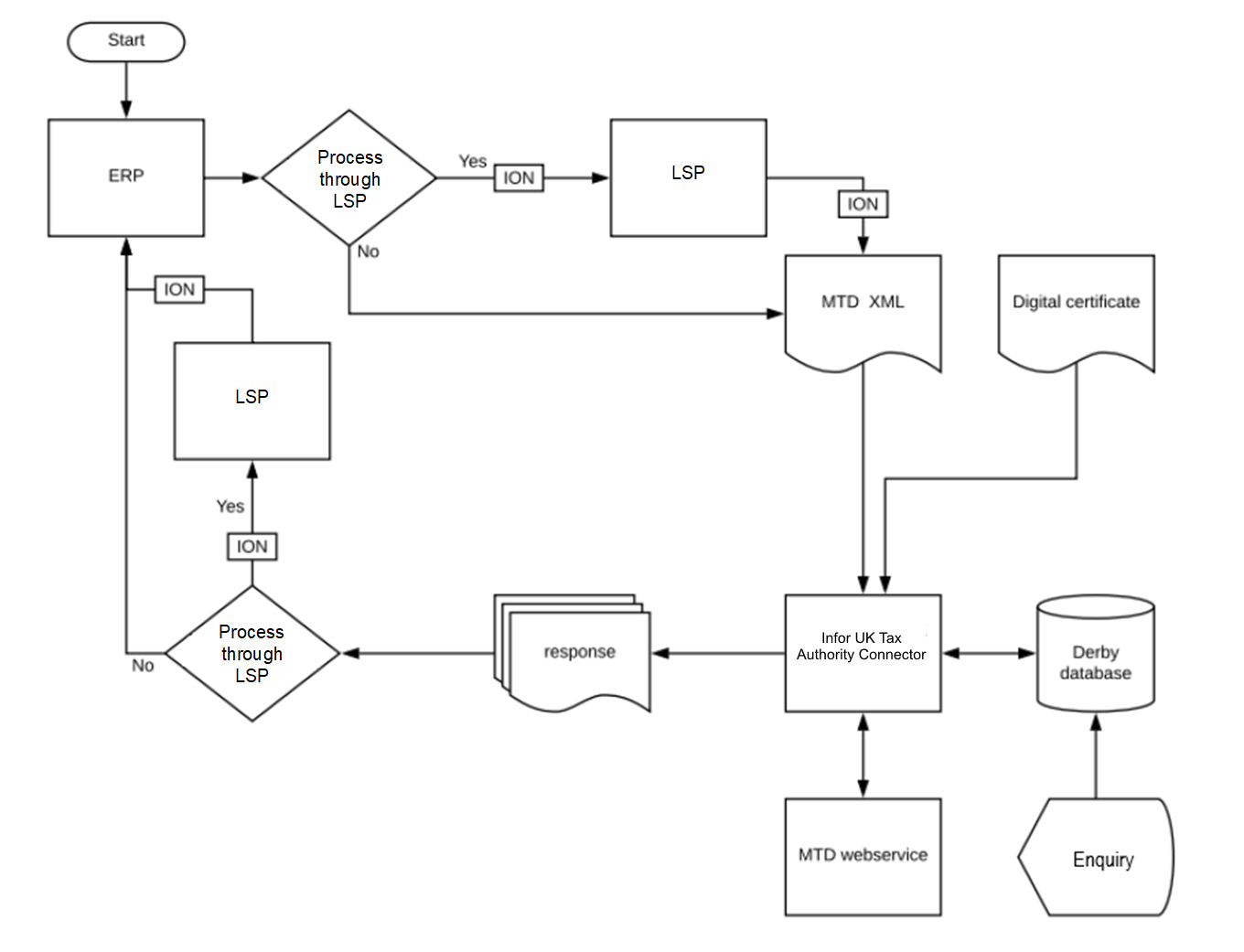

The Infor UK Tax Authority Connector is an independent module that manages the communication between an ERP and the HMRC Making Tax Digital (MTDfB) webservice, either directly or through the Infor Localization Services Platform (LSP). These options are depicted in this diagram:

ERPs may publish a BOD to LSP, or they may supply the MTD XML or VAT 100 XML directly to the connector.

The tax connector converts the XML to JSON format as part of its processing.

Functional overview

The tax connector is an on-premises connector that receives MTD or VAT 100 XML from an ERP directly or through LSP and then manages all communication with the HMRC MTD web service.

The tax connector supports these proprietary formats:

- Retrieve VAT Obligation

- Submit VAT Return for period

- Retrieve VAT Liabilities

- Retrieve VAT Payments

- View VAT Return

The basic processing can be broken down into these three processes:

Outbox Processor

All files received in the outbox are stored in the connector database. The connector will then determine the type of the file and process it accordingly in one of these processes:

- Retrieve VAT Obligation / Retrieve VAT Liabilities or Payments / View VAT Return

- Submit VAT Return for Period

Retrieve VAT Obligation / Retrieve VAT Liabilities or Payments / View VAT Return

- Retrieve the VAT obligation

- Retrieve VAT liabilities

- Retrieve VAT Payments

- View the VAT return

The connector will forward these files to the webservice and then store the resultant response in the inbox, ready for LSP or the ERP to pick up.

Submit VAT Return for Period

This process is invoked when a request to submit the VAT return for a period is stored in the database by the outbox processor.

If a period key is present in the XML, then the connector recognizes that the VAT obligation has already been retrieved. If it has not, then the connector will first retrieve the VAT obligation, using the retrieve VAT obligation process described above, prior to submitting the VAT Return for the period.

MTD Enquiry

This enquiry, which runs over the outbox table, shows the status (received/ sent) and allows you to view the original XML sent. For submissions it allows you to view the submission response.

Error handling

The processing of errors will differ depending on your deployment:

| LSP & Connector | LSP will show all responses from the webservice in the platform. These responses are not sent back to the ERP. |

| Connector only | All responses are stored in a predefined folder ready for the ERP to pick up. |