Setting up accounts

-

In the

Chart of Accounts form at the corporate

(highest-level) entity, add all of your accounts. If your system does not

include any entities, set up the

Chart of Accounts at each site.

You might be able to input your accounts from a spreadsheet that is set up to match the form’s grid view. See Data load to and from spreadsheets.

You cannot add the unit code information in the same spreadsheet as the account information, since they are different collections.

- If you have entities and are consolidating accounts, be sure to add an account with an Account Type of Owner’s Equity to be used as your Cumulative Translation Adjustment (CTA) account.

- Make sure that Inter-entity account numbers used for material transfers at sites that perform transfers with profit are different from your normal sales account numbers. This helps you know what to eliminate as profit when you consolidate to the entity level.

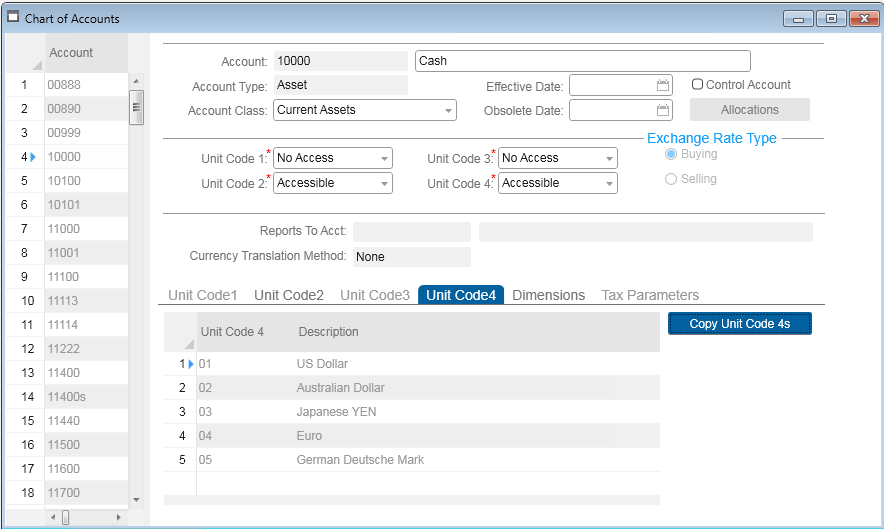

- By default all unit codes are accessible for all accounts. If you want certain unit codes to be required or not accessible for certain accounts, specify that in the Chart of Accounts at the corporate entity. When you save the account record, this message is displayed for each unit code that you marked as not accessible: Any Unit Code x values for this Account will be deleted.

- Click OK.

- Do not set up information on the Unit Code 1-4 tabs yet. This information may be different for each account at each site/entity and will be set up later, after unit codes are defined.

-

If you have multiple levels of entities, perform these tasks. If

you have only one entity, or no entities, skip these tasks.

-

At the corporate entity, use the

Multi-Site Chart Copy form

to copy the chart of accounts from the corporate

entity to any mid-level entities that use the same (or similar) chart of

accounts.

You might see the message Account will be created. If so, click OK. When processing is complete, a message indicates the number of accounts that were processed.

If an error message displays while you are performing this step, see the information in Troubleshooting.

If a different chart of accounts is required at the mid-level entity, then the chart of accounts can be created at the mid-level entity, setting up Reports To accounts to the corporate entity.

-

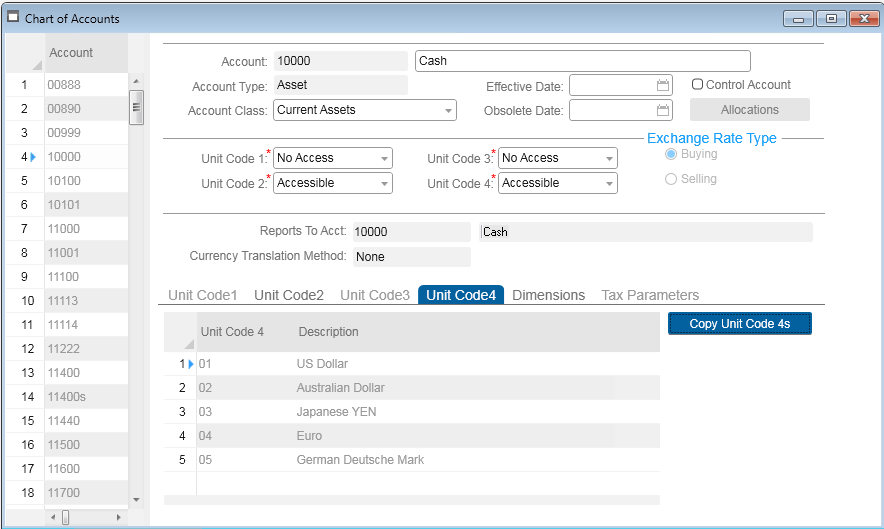

In mid-level entities, use the

Chart of Accounts form to map each account

to a "Reports To" account in the entity being reported to. You must do this in

order for the

Ledger Consolidation utility to work

properly.

- The existing accounts at the higher entity are listed in the Reports To Acct field drop-down. You can map to the same account or to a different account.

- If the mid-level entity’s base currency is different from the higher entity’s base currency, you can specify the currency translation method to use when consolidating the account information. To comply with FASB52 or GAAP standards, you must set the currency translation method to Average for revenue and expense accounts and to End for asset and liability accounts.

-

At the corporate entity, use the

Multi-Site Chart Copy form

to copy the chart of accounts from the corporate

entity to any mid-level entities that use the same (or similar) chart of

accounts.

-

Verify that the

Chart of Accounts was automatically populated in

each of the sites reporting to each entity. This is handled by

ChartAcctRemoteSp in the Ledger Consolidation or G/L replication category.

Users cannot change the chart at the child sites, but they can update descriptions, delete accounts that do not apply to the local database, update obsolete/effective dates, and set up the Unit Code 1-4 tabs for the accounts.

-

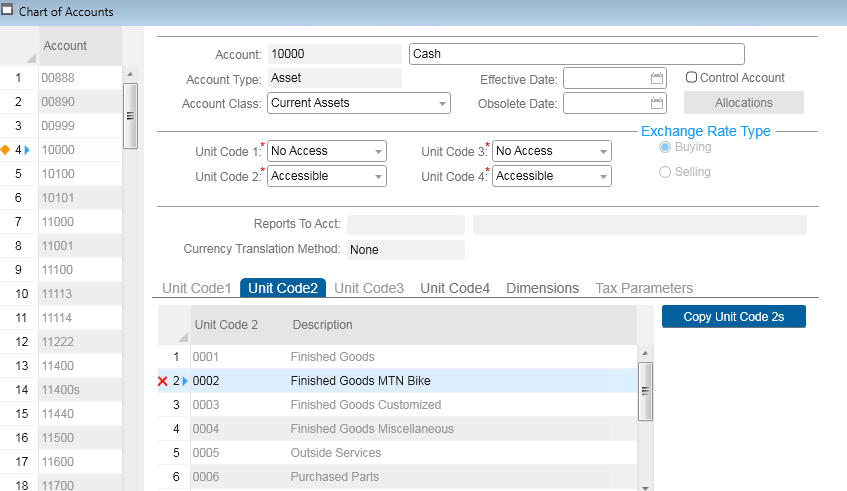

At each site and entity, set up the unit codes that can be

selected for each account.

-

Define unit codes on the

Unit Code 1-4 forms. See the help topic on

"Account Unit Code (1-4)" for information about how unit codes are used.

You might be able to input your unit codes from a spreadsheet that is set up to match the form’s grid view. See Data load to and from spreadsheets for more information.

-

Run the

Copy Unit Codes to Accounts form to copy a

range of unit codes to a range of accounts. This fills in the information for

each account on the

Chart of Accounts form’s Unit Codes tabs at

the site or entity. If an account is set up so that one or more of the unit

codes is inaccessible, the utility does not populate those unit codes.

Run the Copy Unit Codes to Accounts form to copy a range of unit codes to a range of accounts. This fills in the information for each account on the Chart of Accounts form’s Unit Codes tabs at the site or entity. If an account is set up so that one or more of the unit codes is inaccessible, the utility does not populate those unit codes.

-

For greater efficiency, you can copy all unit codes to all

accounts in step b, and then go to the

Chart of Accounts form to delete individual

unit codes from certain accounts, as appropriate.

-

Define unit codes on the

Unit Code 1-4 forms. See the help topic on

"Account Unit Code (1-4)" for information about how unit codes are used.

-

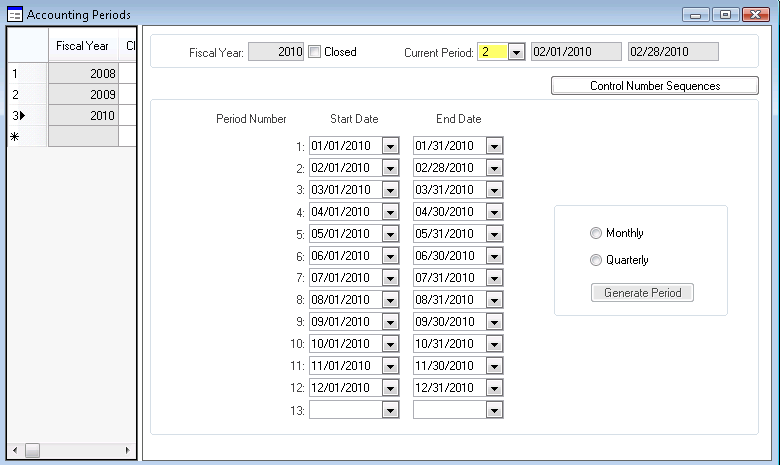

At all entities, in the

Accounting Periods form, add accounting periods.

If your system does not include any entities, set up Accounting Periods at each

site.

Accounting periods that are set at an entity automatically populate each child site’s accounting periods (through Ledger Consolidation or G/L replication). If you have entities, you cannot update accounting periods at the site level. You will maintain the Current Period at all entities and sites.

Accounting periods must be set up manually at mid-level entities. You might want to export the accounting period grid at the corporate entity to a spreadsheet, to use when populating mid-level entities. See Data load to and from spreadsheets for more information.

- Make sure the Accounting Periods were replicated to the appropriate sites.

- If you have multiple levels of entities, do this: at mid-level entities, run the Verify Reports To Account Report, clearing the Invalid Accounts Only flag so that all accounts are listed. Keep this report for future reference. If you have only one entity, or no entities, skip this step.