Managerial Ownership

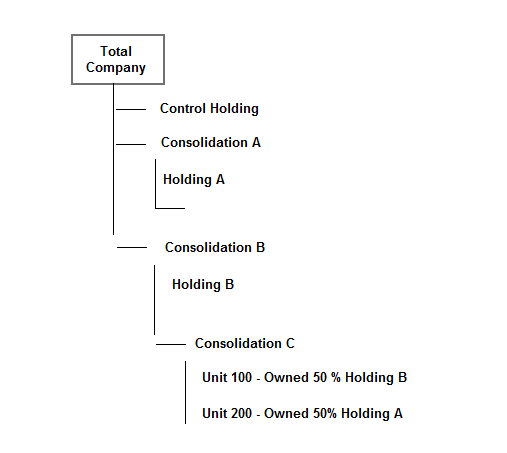

The diagram shows the differences between the standard Ownership Consolidation and the Managerial Ownership consolidation.

Under the Ownership process, Unit 100 and 200 consolidates into Consolidation C at 100%. Unit 100 then consolidates into Consolidation B at 50% while Unit 100 continues to consolidate at 100%. Since Consolidation A is the first point where Unit 200 and its parent, Holding A, are rolled together it is the first point at which ownership percentages are calculated and then applied. Final incorporation of Unit 100 and Unit 200 into Total Company is based on the ownership of Holding A and Holding B by Control Holding.

The Managerial Ownership modifies the ownership percentages only consolidating a unit into an organization structure branch if its parent is in that branch. And the unit is consolidated at the ownership percentage of its first holding parent. In the above structure, Unit 100 will be consolidated into Consolidation C at 50%, reflecting its ownership relationship to its first parent, Holding B. Unit 200 is not consolidated into Consolidation C nor Consolidation B because its first parent, Holding A is not an ancestor of this organization structure. Unit 200 is first incorporated into results with its parent Holding A at Consolidation A. Final incorporation of Unit 100 and Unit 200 into Total Company is based on the ownership of Holding A and Holding B by Control Holding.

While the results reported at Consolidation C, Consolidation B and Consolidation A will be different between the Ownership and the Managerial Ownership process, the results reported at Total Company are the same.

Information on more complex scenarios is available on Infor Xtreme Support portal. See Knowledge Base article 1105318 for details.